The Foundation in Sustainable Insurance certificate

TRAINING

Developed by insurers

Climate change and the transition to a low carbon economy creates once-in-a-generation risks, threats and opportunities for (re)insurers, brokers and insureds. Educating insurance professionals is a critical step in future-proofing (re)insurance businesses and meeting stakeholder expectations.

Better Insurance Network has developed, in collaboration with a group of leading insurance organisations, the industry's first dedicated sustainability e-learning programme – 'Sustainability for Insurers' – to equip insurance professionals with a solid grounding in industry and role-specific sustainability.

Learners can access CPD-accredited learning pathways of 90 minutes (Essentials) to 8+ hours, (achieving the Foundation in Sustainable Insurance certificate).

Better Insurance Network has developed, in collaboration with a group of leading insurance organisations, the industry's first dedicated sustainability e-learning programme – 'Sustainability for Insurers' – to equip insurance professionals with a solid grounding in industry and role-specific sustainability.

Learners can access CPD-accredited learning pathways of 90 minutes (Essentials) to 8+ hours, (achieving the Foundation in Sustainable Insurance certificate).

Developed in collaboration with

How it works

Sustainability for Insurers is available to individuals and organisations on an annual subscription basis. Learners access a structured, digestible syllabus of e-learning videos and supporting materials, featuring insights from dozens of expert practitioners. The learning content is regularly updated to keep pace with fastmoving regulation and best practices.

For organisations, learning paths can be tailored to suit the company and specific job roles. The content can be enriched with bespoke content aligned with the organisation’s own approach. The training is deployed via Better Insurance Network’s own learning management system (LMS) or can be licensed for deployment via a company’s own LMS.

For organisations, learning paths can be tailored to suit the company and specific job roles. The content can be enriched with bespoke content aligned with the organisation’s own approach. The training is deployed via Better Insurance Network’s own learning management system (LMS) or can be licensed for deployment via a company’s own LMS.

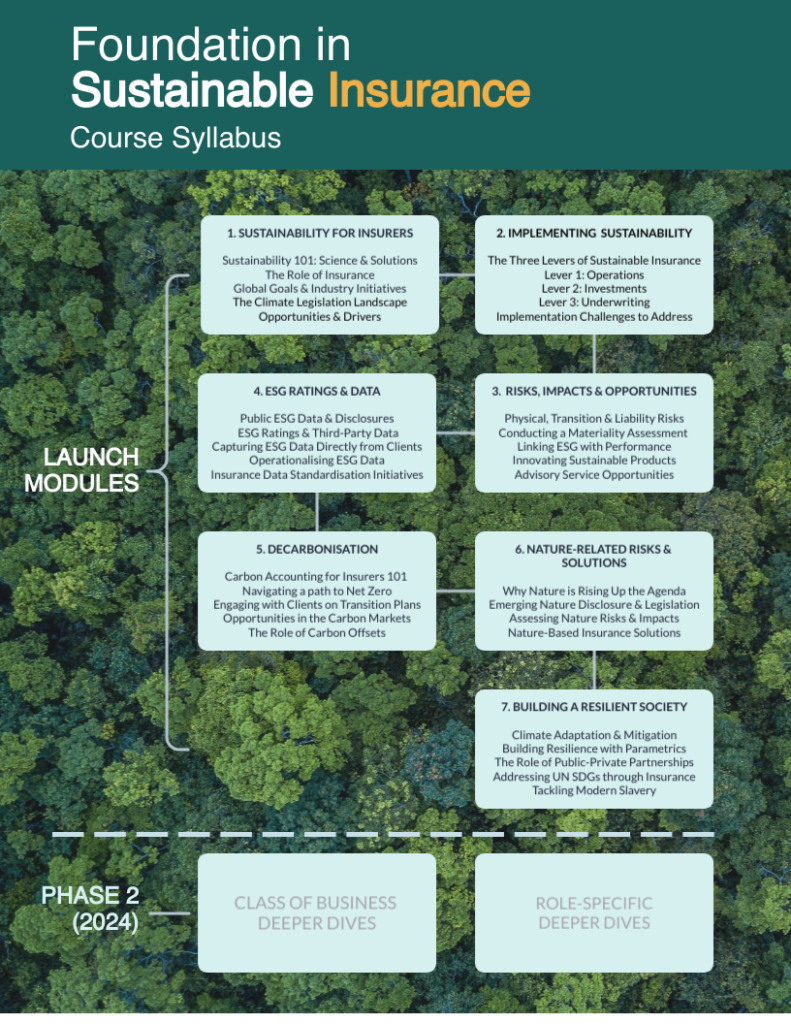

Construct your own learning path

from a modular syllabus

Course content

Insurance context

Sustainability goals, drivers, risks & opportunities

Implementation levers

Underwriting, investments & operations

Decarbonisation

Metrics, targets, transition plans, PCAF standard

Materiality

Quantifying key risks, opportunities & impacts

Class deeper dives

Key factors & transition risks, specialist insights (Phase 2)

ESG data

Capturing client data, ESG ratings, using the data

Climate adaptation

Integration in insurance business models

Nature

Risks, opportunities, regulation & solutions

Societal resilience

Addressing UN SDGs through insurance

Pricing

Foundation in Sustainable Insurance Certificate

Prices exclude VAT. 20% discount for premium/associate members

Essentials

only

Master the basics in just a few hours

Team

- Better Insurance Network LMS

- Tailorable learning paths

- Bespoke content (optional)

- White label branding

- Packages for 10-500 learners

- Detailed reporting

- Low user cost

Enterprise

- Self-hosted (content licence)

- Tailorable learning paths

- Bespoke content (optional)

- Self-branded

- Unlimited # learners

- Full control of deployment

- Low user cost

Arrange a call to discuss your training needs

Course contents

- 16 Shrewsbury Road, Redhill, Surrey, RH1 6BH, United Kingdom

- [email protected]

Copyright © 2023 Better Insurance Network

Follow Us